jefferson parish property tax records

Fax the request to 504 736-6307. Jefferson Parish Assessors Office - Property Search.

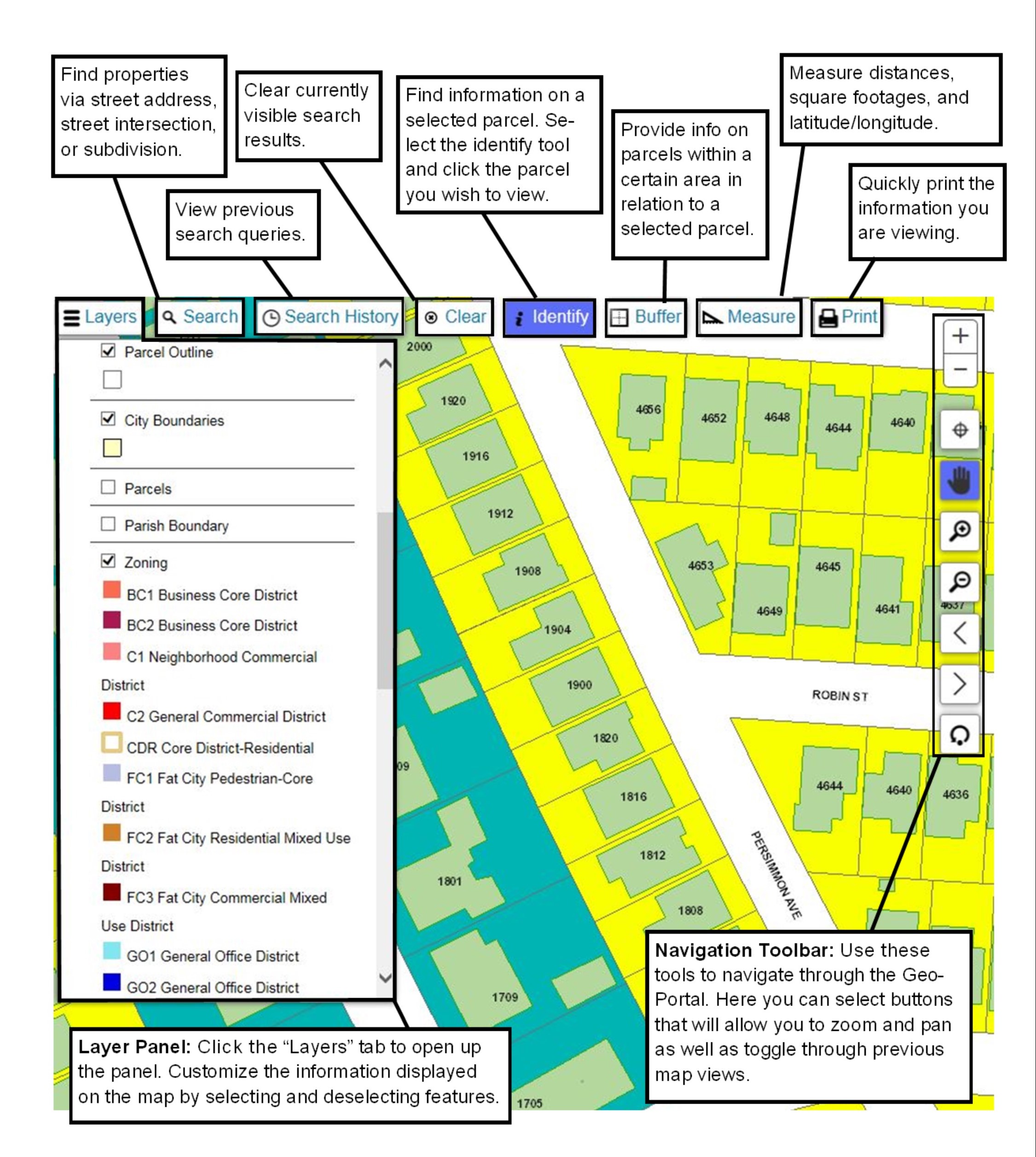

Before you start here are a few things you should know about this application.

. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Property Tax Payment Options Hotel Occupancy Tax Vehicle Inventory Tax Tax Certificates.

Click Advanced for more search options. Jefferson Parish Health Unit - Metairie LDH. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The Assessors office is responsible for uniformly and accurately appraising and assessing all property in Jefferson Parish for property tax purposes. Please call 504-362-4100 and ask for the personal property department if you have any questions. The Assessors office offers you information regarding your homestead exemption millage rates ownerships property valuation and information for business owners as well.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 1221 Elmwood Park Boulevard Suite 701. Jefferson Parish Attorneys Office.

Jefferson County Courthouse 1149 Pearl Street. Try Searching Yourself Now. You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100.

Its Fast Easy. They are maintained by various government. Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Jefferson Parish has developed a Geographic Information Systems GIS database using aerial photography and field investigations. What is the property tax for 662 Dodge Avenue.

Jefferson Parish Permits 822 South Clearview Parkway Elmwood LA 70123 504-736-7345 Directions. They are a valuable tool for the real estate industry offering. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

A 249 convenience fee is assessed on all credit card payments. 200 Derbigny St Suite 1100. Enter one or more search terms.

JEFFERSON PARISH HOSTS MEMORIAL DAYCERERMONY ON MAY 26 2022 AT 900 AM. Public Records Request Public Works Service Request Sanitation Complaint Mosquito Stagnant Water Litter Trash Complaint. Property Tax 409 835-8516.

Our office is open for business from 830 am. 1801 Williams Blvd Kenner LA 70062 Police 504 712-2222 or 911 Fire Department 504 467-2211 or 911 City Hall. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am.

Find Jefferson Parish residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions. Any of the following are accepted means of transmitting your request for public records. The Jefferson Parish Assessors Office has its books open for public inspection for a period of fifteen 15 days each year between August 1 and ending no later than September.

Search results are returned within moments as you type. Ad Tax Records Found By Just Typing in a Name State. Jefferson Parish makes no warranty as to the reliability or accuracy of the base maps their associated data tables or the original data collection process and is not responsible for the inaccuracies that could have occurred due to errors in the.

Download a Full Property Report with Tax Assessment Values More. Welcome to the Treasurer Property Tax Records and Payment Application. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Our property records tool can return a variety of information about your property that affect your property tax. These taxes may be remitted via mail hand-delivery or filed and paid online via our website. Select one of the search options from the left navigation pane Owner Address PIN or AIN to search for and view property tax information.

They are maintained by various government offices in Jefferson Davis Parish Louisiana State and at the Federal level. Jefferson Parish Permits 3300 Metairie Road Metairie LA 70001 504-832-2399 Directions. If you have documents to send you can fax them to the.

Select one of the. Tax Assessor-Collector of Jefferson County Texas. Free Jefferson Parish Assessor Office Property Records Search.

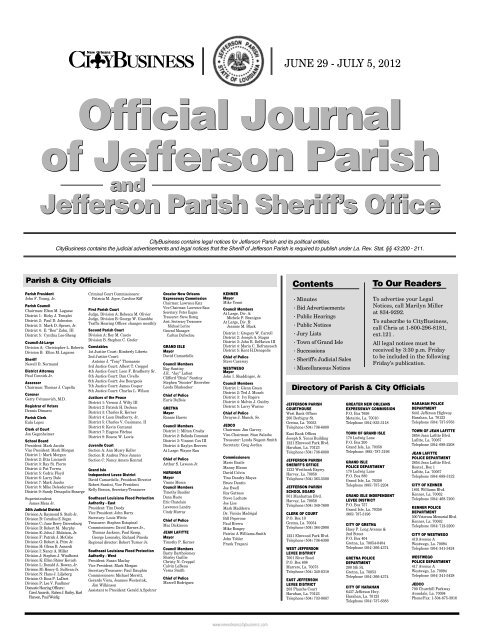

Jefferson Parish Sheriffs Office. The telephone is 504-363-5637. Welcome to the Jefferson Davis Parish Assessor Web Site.

The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. For a tax research certificate for purposes of LA RS. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

Only open from December 1 2021 - January 31 2022. You may call or visit at one of our locations listed below. The preliminary roll is subject to change.

This ceremony will take place at the Veterans Memorial Square on Veterans Blvd. There is no fee for e-check payments. Get Property Records from 8 Building Departments in Jefferson Parish LA.

JEFFERSON LA Parish President Cynthia Lee Sheng along with other Parish officials will be hosting a Memorial Day Ceremony on Thursday May 26 2022 at 900 am. The preliminary roll is subject to change. Search By Tax Year Payments are processed immediately but may not be reflected for up to 5 business days.

Jefferson parish property tax search. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Jefferson Parish Permits 400 Maple Avenue Harvey LA 70058 504-364-3512 Directions.

All Jefferson Parish Public Records Louisiana Nearest Airport. Mail the request to the following address. Mail the form to.

Smith John or Smith. This property includes all real estate all business movable property personal property and all oil gas property and equipment. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

2022 Assessor Property Records Search Jefferson County CO. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. View Pay Water Bill.

To 430 pm Monday through Friday. Jefferson Parish makes no warranty as to the reliability. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana.

Jefferson Parish Assessors Office - Property Search. Voter Registration 409 835-8683. If You Enter Your Name On This Site The Results Will Surprise You.

Property Tax Overview Jefferson Parish Sheriff La Official Website

Our Views The Times Picayune Makes These Recommendations On Parish Tax Proposals Our Views Theadvocate Com

What Jp Residents Need To Know To Pay Property Tax

Hurricane News And Information

Hurricane News And Information

Hurricane News And Information

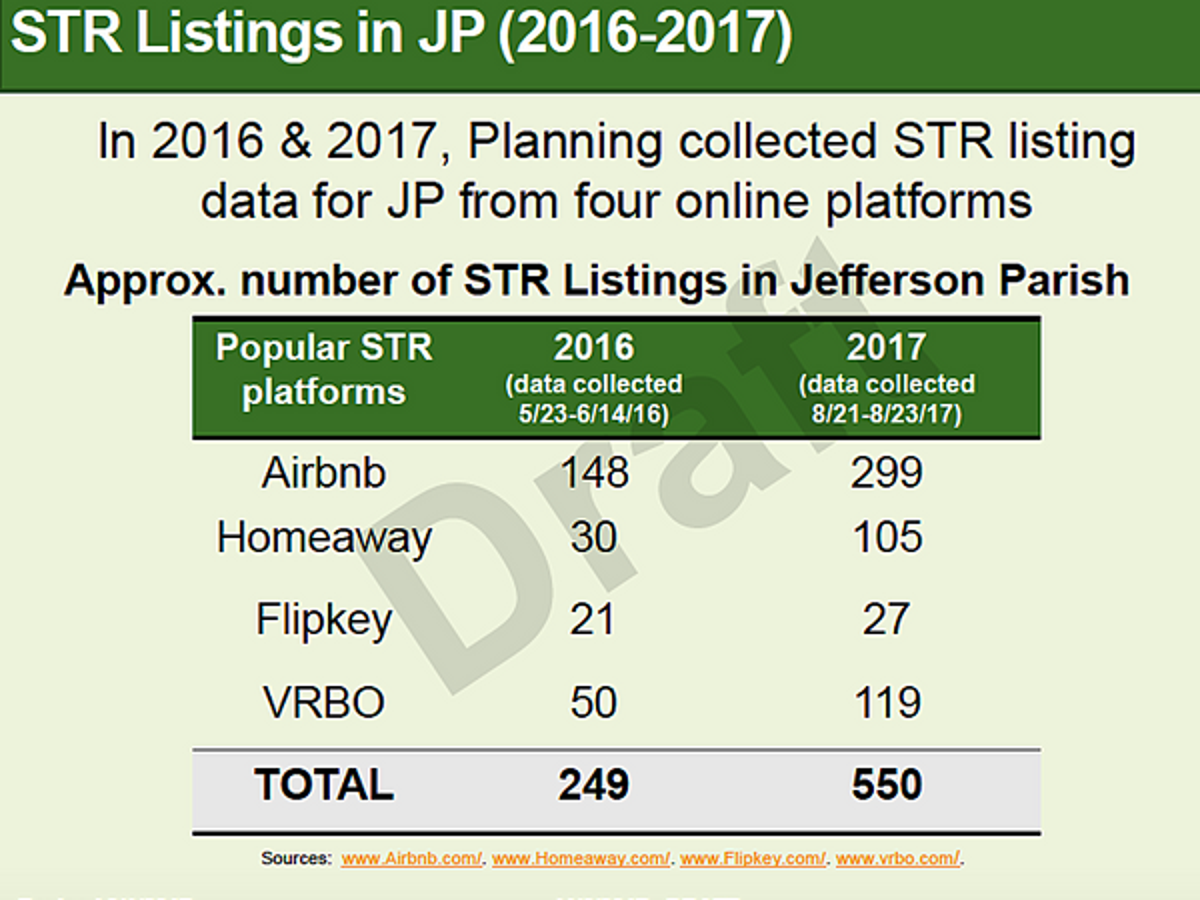

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

Jefferson Parish Sheriff La Official Website Official Website

Home Page Morehouse Parish Assessor S Office

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/TIYXPVQXZBHOTLIW6LWZPBXZNU.jpg)

Jefferson Parish Voters Set To Decide On Millage Increase To Fund Sheriff S Office Hiring Raises

St Tammany Parish Sheriff 007 Sheriff Office Sheriff Police Cars

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Property Tax Overview Jefferson Parish Sheriff La Official Website